oklahoma franchise tax form

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return.

Forms - Business Taxes Forms - Income Tax Publications Exemption Letters All Taxes Income - Individual Income - Businesses Motor Vehicles Gross Production Online Registration Reporting Systems Rates Rebates.

. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Fill Online Printable Fillable Blank 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200.

Form 200-F must be filed no later than July 1. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Only those corporations with capital of 20100000 or more are required to remit the franchise tax.

Corporations that remitted the maximum amount of franchise tax for the. All organizations falling within the purview of the Franchise Tax Code. Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999.

Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 151 minutes to complete The 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma form is 48 pages long and contains. File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S.

To make this election file Form 200-F. Franchise Tax Computation The basis for computing your Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of your last preceding income tax accounting year or if you have elected to change your. Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date.

Printing and scanning is no longer the best way to manage documents. You may file this form online or download it at taxokgov. Change Franchise Tax Filing Period.

Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Oklahoma Form Franchise Tax online eSign them and quickly share them without jumping. The report and tax will be delinquent if not paid on or before September 15. All forms are printable and downloadable.

The new franchise tax rule limits taxpayers annual obligation to a. The franchise tax is calculated at the rate of 125 for each 100000 of capital employed in or apportioned to Oklahoma. Handy tips for filling out Oklahoma Form Franchise Tax online.

Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now. Your Oklahoma return is due 30 days after the due date of your federal return. See page 16 for methods of contacting the Oklahoma Tax Commission OTC.

Select Popular Legal Forms Packages of Any Category. Franchise Tax Payment Options New Business Information New Business Workshop. To make this election file Form 200-F.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not use this form to remit franchise tax.

Once completed you can sign your fillable form or send for signing. To make this election file Form 200-F. The Oklahoma franchise tax is mandatory for all for-profit corporations including S-corporations partnerships and limited liability companies organized and maintained in Oklahoma.

You can download this form from the Oklahoma Tax Commission website wwwtaxokgov. All Major Categories Covered. If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F.

Franchise Tax If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Reinstatement of the franchise tax in 2014 followed a moratorium and enactment of a business activity tax in 2010. Corpora-tions not filing Form 200-F must file a stand-alone Oklaho-ma Annual Franchise Tax Return Form 200.

Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free. The maximum amount of franchise tax that a corporation may pay is 2000000. Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st.

Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. How is franchise tax calculated.

Franchise Tax Computation. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. A ten percent 10 penalty and one and one-fourth percent 125 interest per month is due on payments made after the due date.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. To make this election file Form 200-F.

Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form.

Mine the amount of franchise tax due. These elections must be made by July 1.

ร บแปลส ญญา Law Firm Lawyer Family Law Attorney

Pin By Ca Gulshan Sharma On Legal Services Goods And Service Tax Legal Services Registration

Vestige Membership Form All You Need To Know About Vestige Membership Form Vestige Essay Outline Template Network Marketing Business

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise

Printable Ca Form 540 Resident Income Tax Return Pdf Formswift

Amazon S New Prime Air Drone Can Morph From Helicopter To Plane Air Drone Amazon New Drone Technology

Wwii Monopoly Game The Escape Version Inventions Being A Landlord Board Games

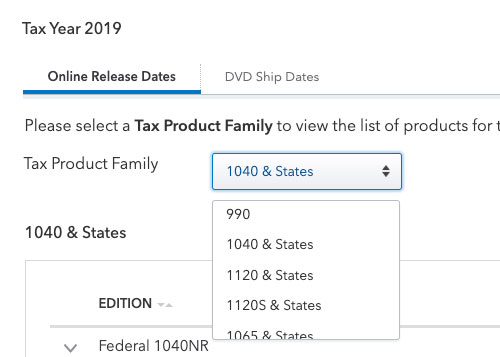

Form Availability Proseries Professional Tax Software

Free Direct Deposit Authorization Form Pdf Word Eforms

Jurassic Park Playing Cards Jurassic Park Jurassic Deck Of Cards

35 Body Language Secrets That Will Help You Get Ahead At Work Body Language Language Body

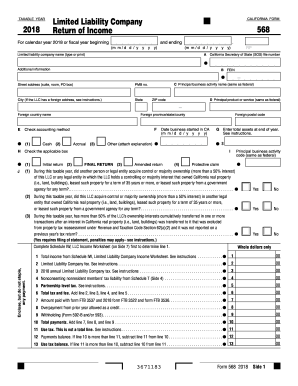

Filing Form 568 Fill Out And Sign Printable Pdf Template Signnow

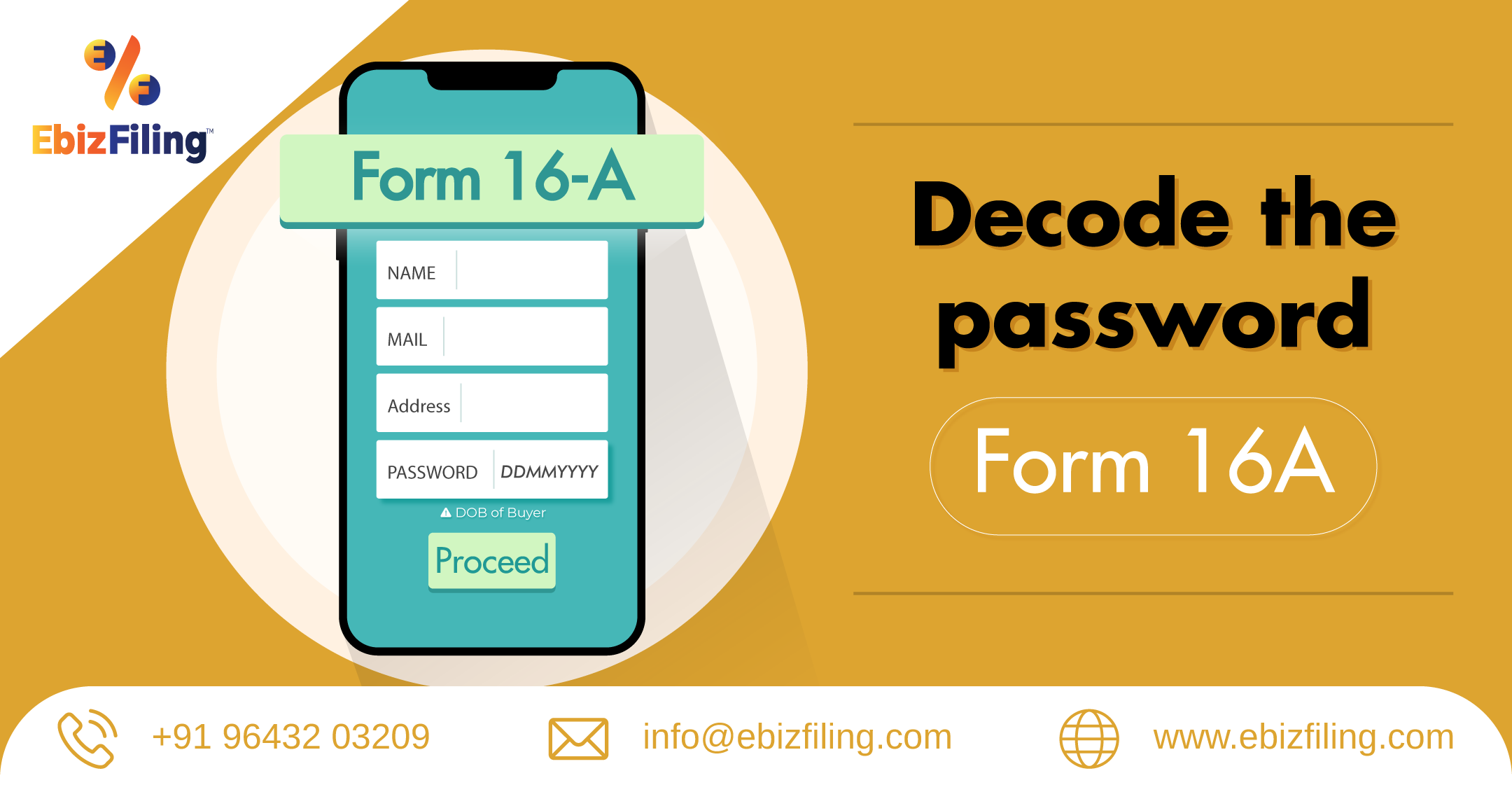

What Is The Password For Tds Form 16a Ebizfiling

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

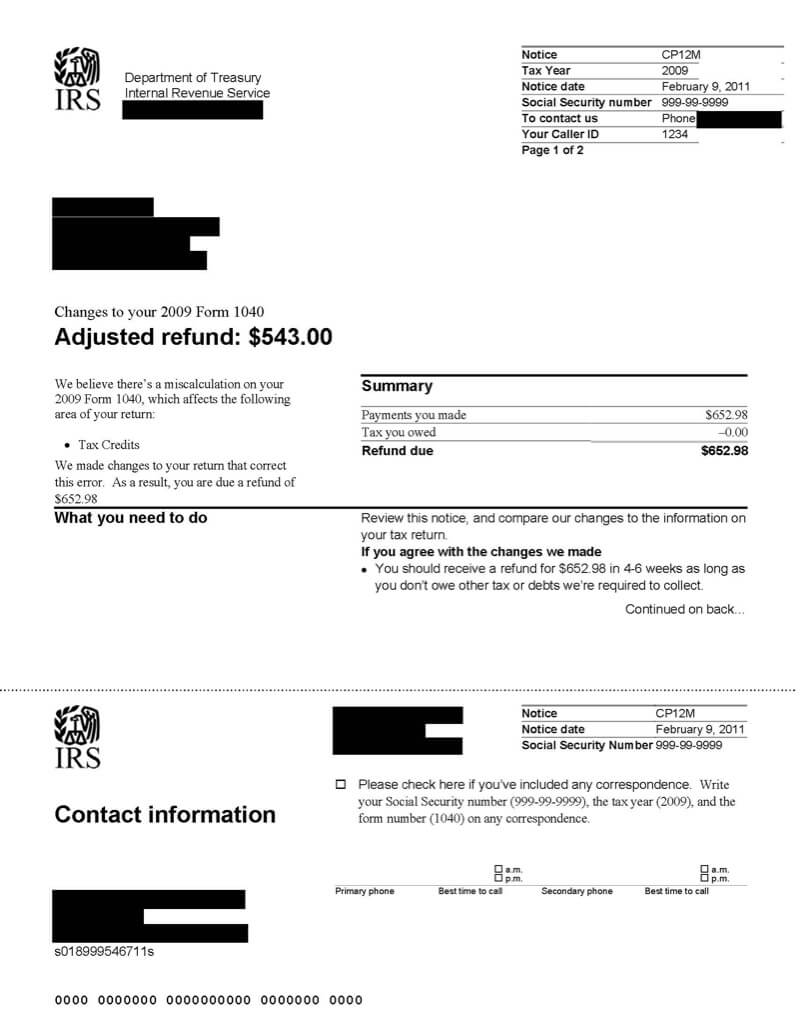

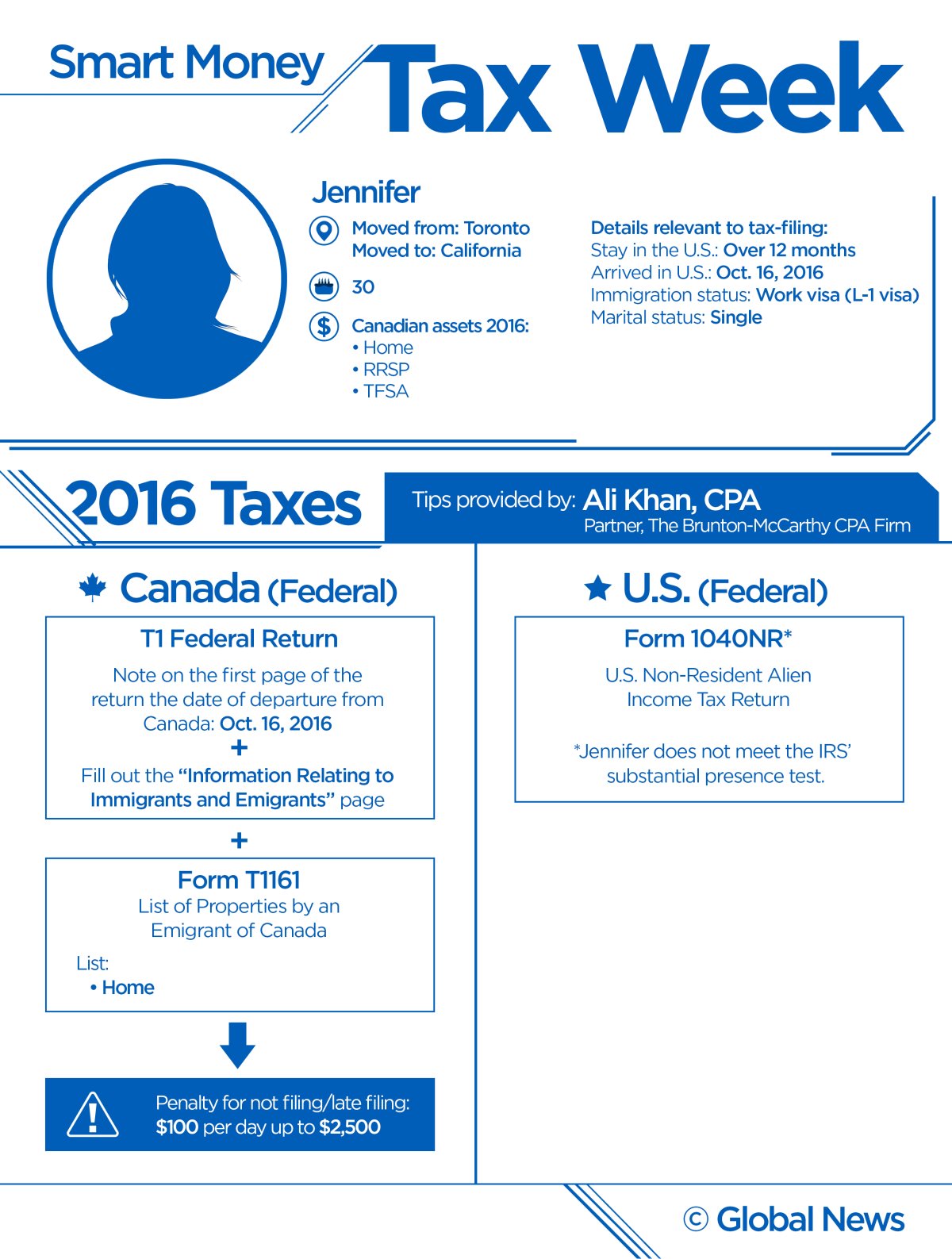

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca